What is the difference between off-trip coverage types?

If you’re looking for more information explaining the types of off-trip insurance coverages available, you’ve come to the right place.

Liability + Comprehensive & Collision:

Means that you are covered if you are legally responsible for any damage or injury your vehicle causes to others in an accident, and covers damage to your vehicle as well. This covers things like collision with another vehicle or object, accidents with uninsured drivers, theft, vandalism, and storm damage, Personal injury protection (yourself, employees, passengers), and damage to your vehicle.

Liability only*:

Means that you are covered if you are legally responsible for any damage or injury your vehicle causes to others in an accident. This covers things like third party medical bills, damage to other vehicles or property, and legal fees.

*Liability only coverage does not cover your vehicle from physical damage or injury to yourself, your employees, or passengers in your vehicle.

If you’ve already purchased liability coverage and want to also obtain comprehensive and collision, we’ve made it easy to do so in our portal.

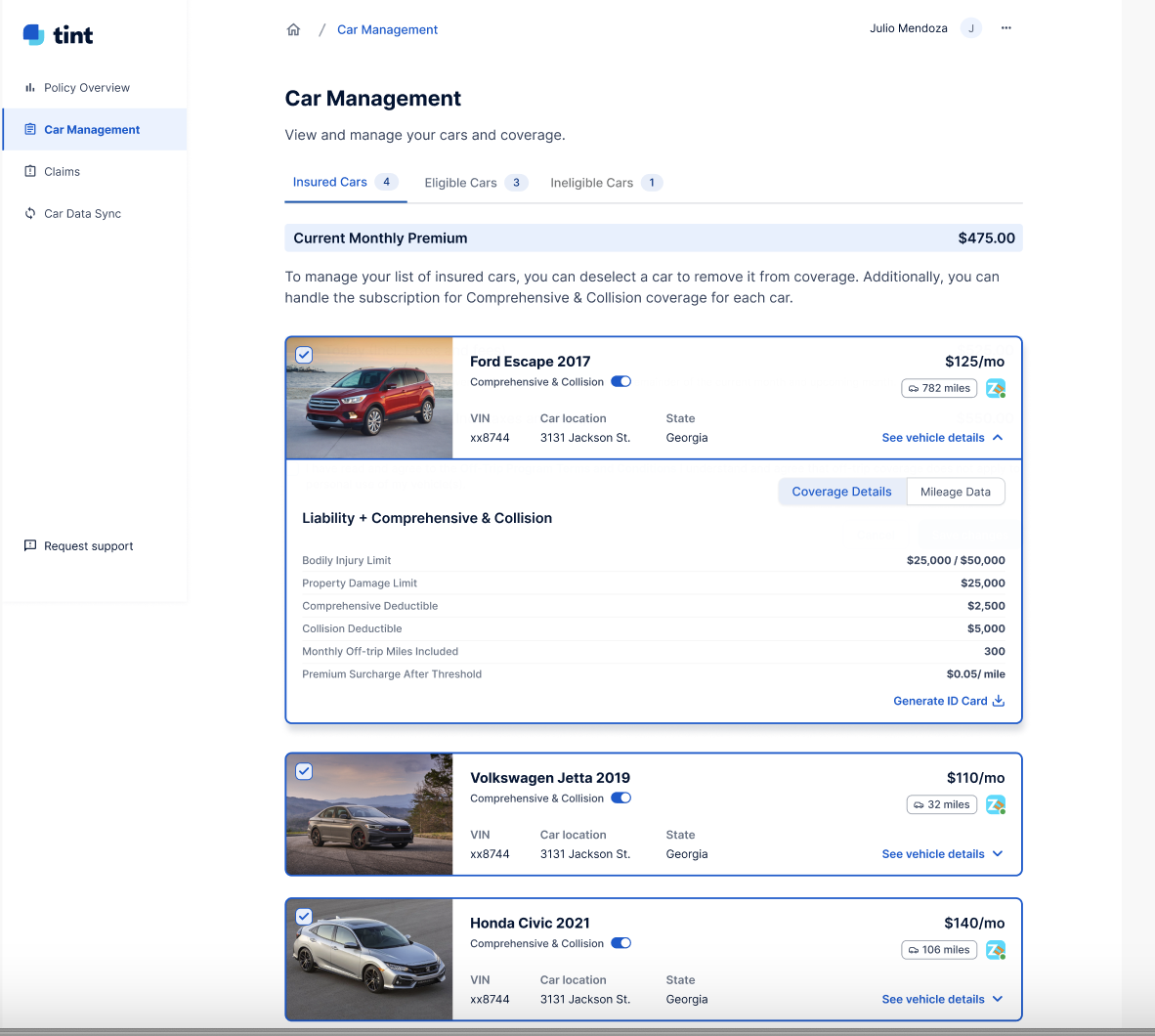

Adding Comprehensive & Collision Coverage in the Tint Portal

Step 1: Sign in to the portal using your secure link.

Step 2: Navigate to “Car Management”

Step 3: Toggle “Comprehensive & Collision” next to the photo of any vehicle you’d like to add coverage for.

Step 4: Click “Save Changes” and it will show you the adjusted premium and the amount due to process the change. Note - this will charge the payment method we have on file.

Disclaimer: Insurance is offered through Tint Embedded Insurance Services, LLC, a licensed surplus lines insurance broker, and underwritten by a non-admitted insurance carrier. In case of the insurance carrier’s insolvency, payment of claims may not be guaranteed. The information provided herein is for general informational purposes only and not intended as a solicitation of insurance. Such information does not in any way alter or amend the terms, conditions, or exclusions of any insurance policy. Insurance coverage may not be available in all jurisdictions or to all customers.