Understanding Coverage at the Vehicle Level

Off-trip insurance coverage with Tint is designed to give you the flexibility you need to manage the insurance for your fleet of vehicles. This means you must decide between liability-only or full comprehensive and collision coverage that best suits your needs.

What Coverage is Available with Tint

Off-trip coverage is assigned at the vehicle level. This means you can choose what level of coverage is right for each vehicle you own. You’ll be able to select coverage level during your initial purchase and anytime after that within the Tint Portal. To provide you with the best coverage options while your vehicles are not on a trip, you can choose a plan that includes Liability & Comprehensive + Collision or Liability only coverage. It is important to know that Liability coverage is legally required for vehicles in the U.S. and for all vehicles with off-trip insurance. Comprehensive & collision coverage is not offered as a stand-alone insurance option.

Liability + Comprehensive & Collision

What is it? Coverage if you are legally responsible for any damage done to other vehicles or any injuries your vehicle causes to others in an accident and covers damage to your vehicle as well.

Liability Only

What is it? Coverage if you are legally responsible for any damage or injury your vehicle causes to others in an accident.

Liability-only coverage does not cover your vehicle from physical damage or injury to yourself, your employees, or passengers in your vehicle.

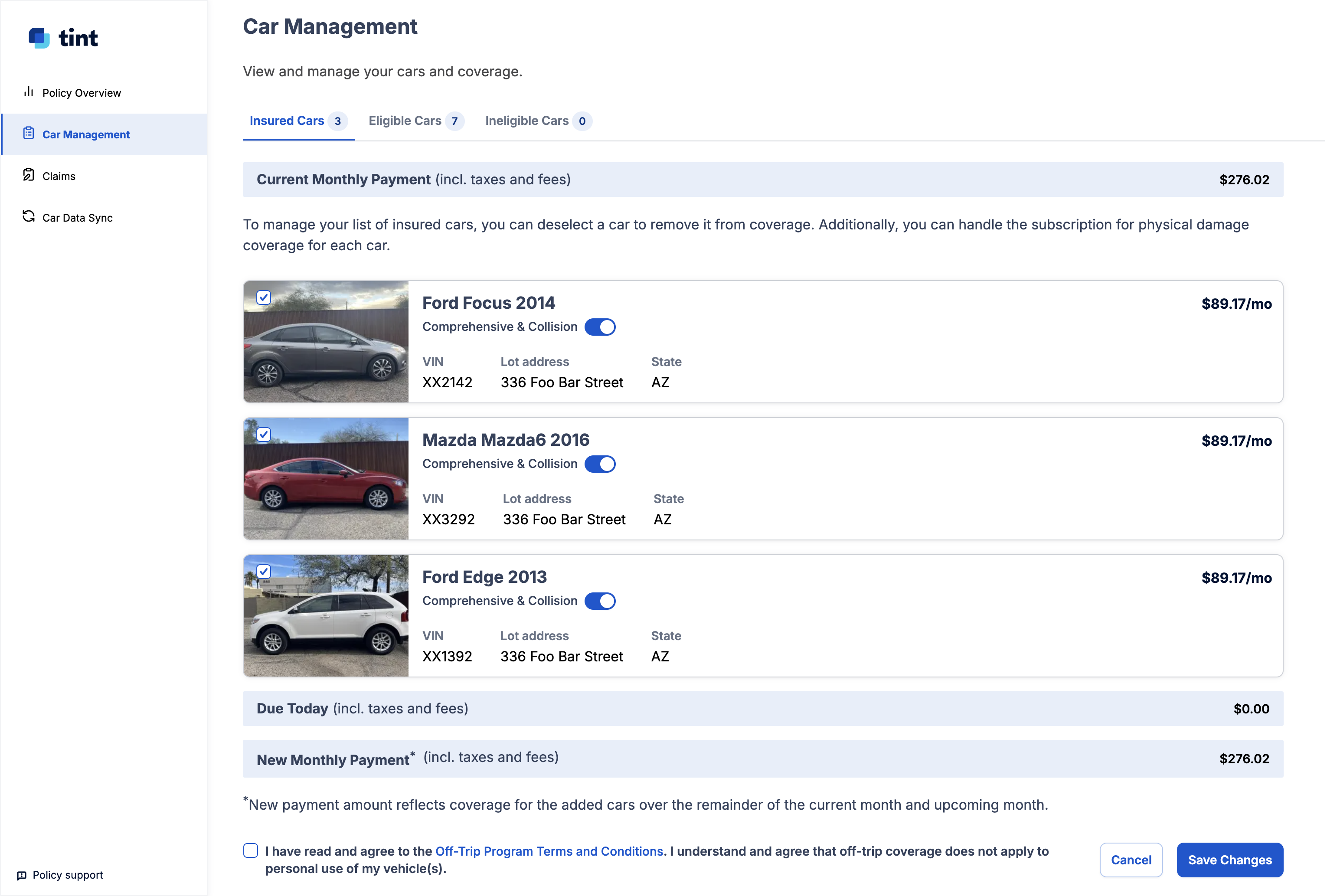

Where Can I See My Coverage Options?

You have two opportunities to add or adjust your off-trip insurance coverage with Tint. The first is when you make your initial purchase the second is after you’ve already signed up for a policy and need to make adjustment in our portal. We’ll walk you through, step-by-step, the process for both.

Where can I see what coverage I currently have? Great question.

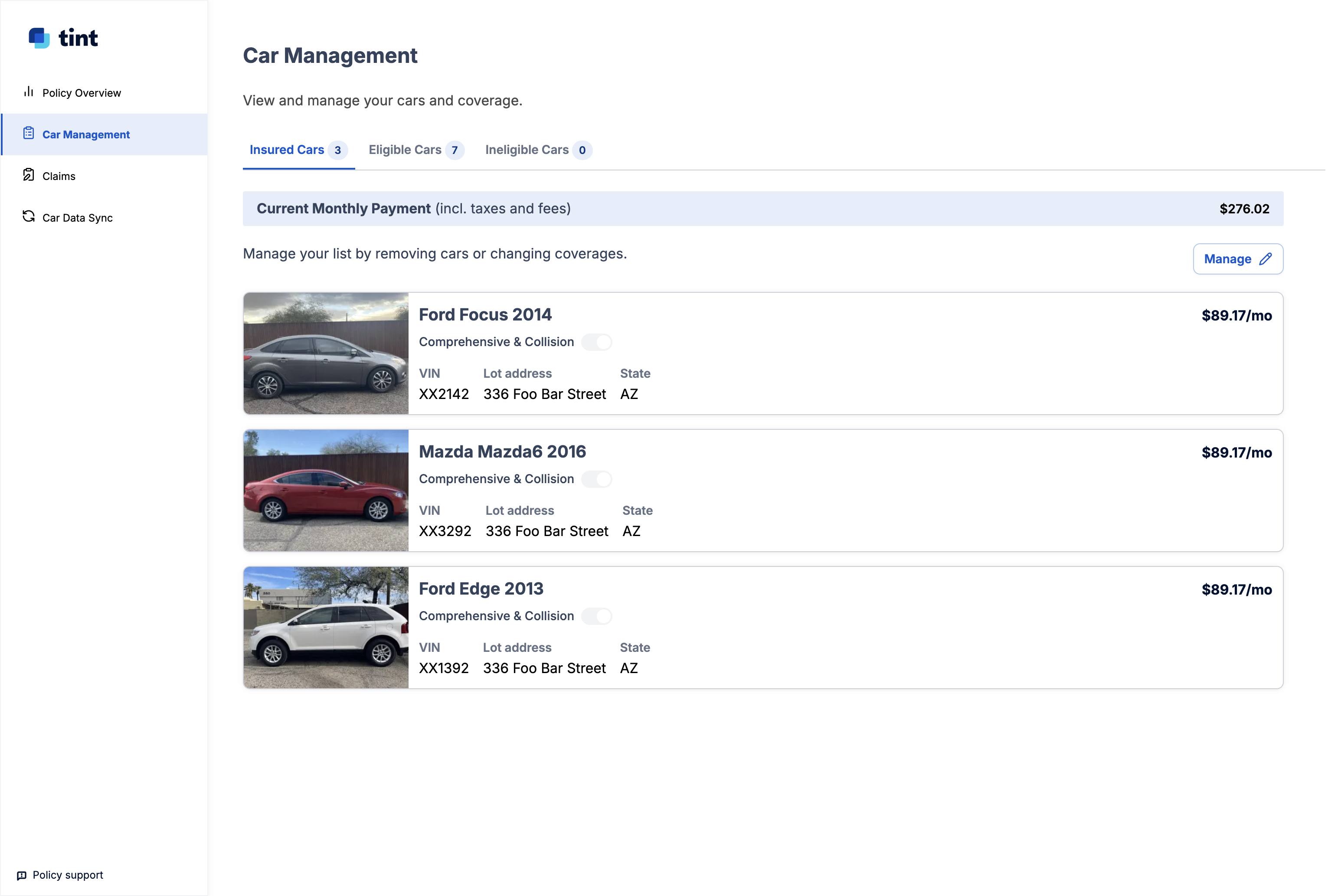

Sign In to the Tint Portal

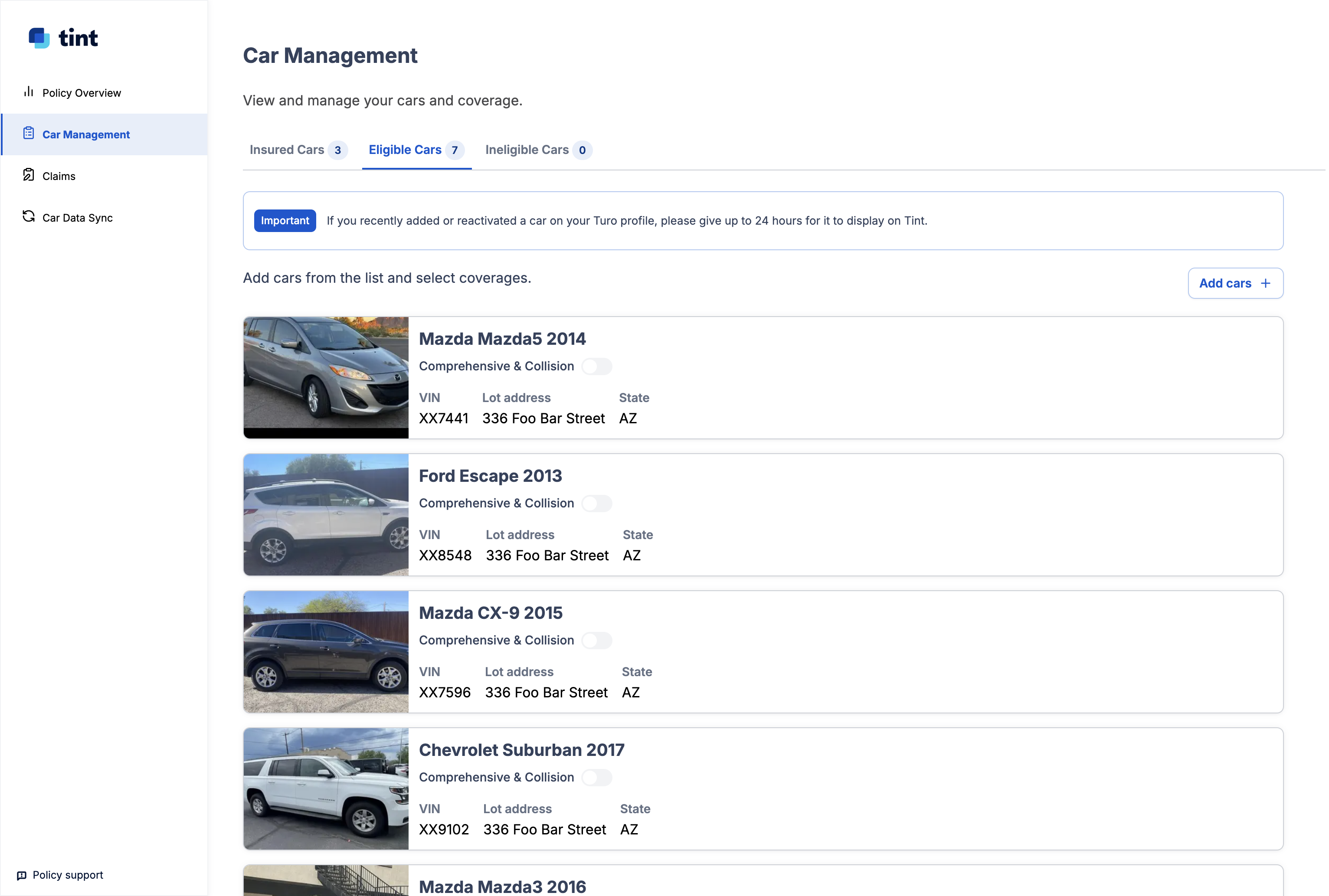

Navigate to “Car Management”

Scroll through your insured, eligible and ineligible vehicles to view coverage level

Note: If you toggle the “Comprehensive & Collision” button, your coverage for the vehicle selected will be adjusted and will impact your next billing cycle.

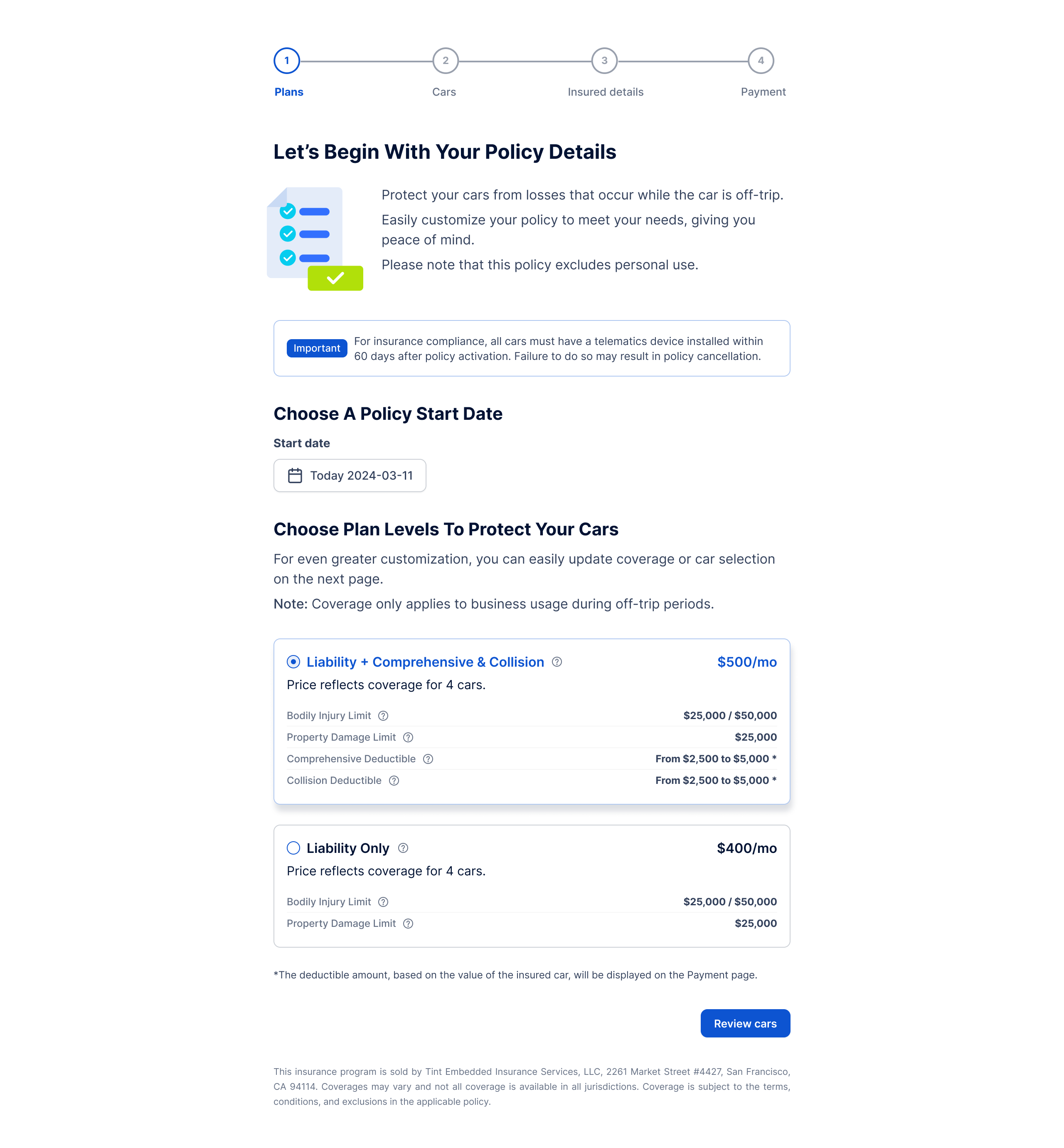

Within Tint’s Purchase Flow

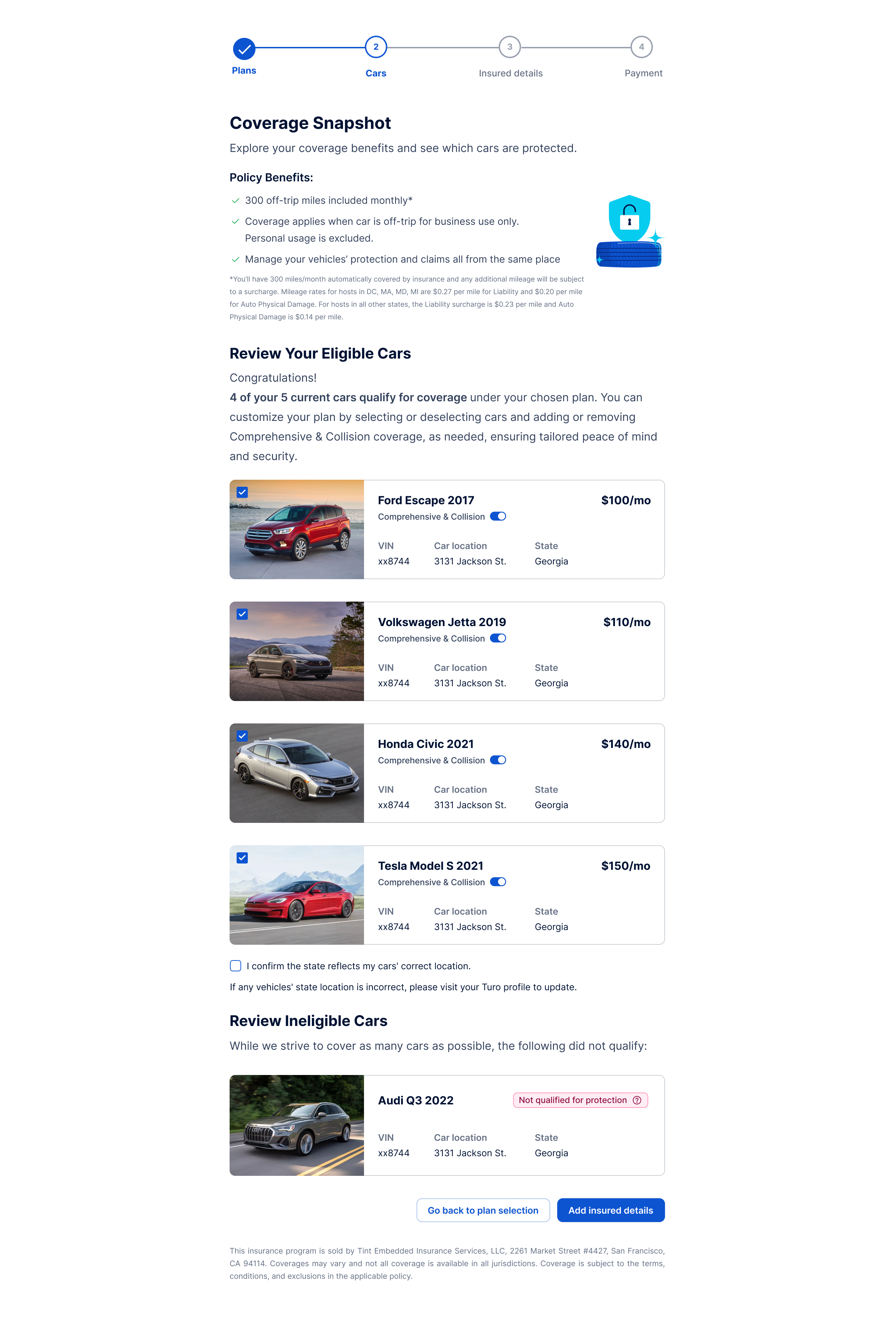

Signing up for coverage with Tint is easy, we’ve done the hard work for you! All of your Turo vehicles will pre-populate in our purchase flow. You’ll be able to clearly see vehicles that are eligible for coverage and those that are not. When you purchase insurance with Tint for the first time, you will take the following steps in our purchase flow:

Sign in with passwordless authentication

Begin by selecting the policy start date you’d like and coverage level

Review your eligible cars, you can toggle coverage at the vehicle level at this screen

Within Tint’s Portal

If you have already purchased coverage and are looking to add coverage for a new vehicle or update coverage for an existing vehicle, you can easily do so through Tint’s portal.

Sign in with passwordless authentication

Navigate to “Car Management”

Scroll through your insured, eligible and ineligible vehicles to view coverage level

Note: If you toggle the “Comprehensive & Collision” button, your coverage for the vehicle selected will be adjusted and will impact your next billing cycle.

Making Coverage Changes to An Existing Policy

You may find that you want to add or update coverages to your existing policy. The steps to change your coverage level from liability only to liability + comprehensive and collision coverage are very simple in the Tint portal. You’ll take the steps outlined above to view coverage in the Tint portal and then you can make the following adjustments.

Adding Comprehensive & Collision Insurance

Start in “Car Management”

Find the vehicle you are looking to adjust

Toggle the “Comprehensive & Collision Coverage” on

Removing Comprehensive & Collision Insurance

Start in “Car Management”

Find the vehicle you are looking to adjust

Toggle the “Comprehensive & Collision Coverage” on

Differences Between Comprehensive + Collision & Liability-Only

Liability-only coverage doesn’t protect from physical damage to your vehicle. This level of coverage meets the minimum requirement for each state the program is offering in and can be a great way to save money on your monthly premium payments. However, because it doesn’t offer that physical damage protection, there could be out of pocket expenses later that you should be prepared for.

Liability, plus comprehensive and collision coverage protects your vehicle from physical damage as well. No one likes surprises that come with a large bill at the auto body shop. If you want to ensure that your vehicles are protected from physical damage, comprehensive coverage may be right for you. If you want to understand your deductible options, please take a look at this article for more information.

When Liability Only Coverage Isn’t Right For You

If you like the lower monthly payments of liability-only coverage but aren’t sure if it is the right level of protection, we’ve put together a list of some common reasons why liability only coverage may not be right for you.

Your lender requires additional coverage. Some lenders require comprehensive and collision coverage, in addition to liability coverage. Be sure to check with your lender to ensure that your coverage meets their minimum requirements.

Your vehicle is new (or relatively new). If your vehicle is a newer model year, you may want to consider coverage that protects your vehicle(s) from physical damage. Newer cars often cost more to fix than older models.

The value of your vehicle. If your vehicle(s) has higher costs for replacement parts, it may be beneficial to invest in a higher monthly premium - rather than pay out of pocket if your vehicle is damaged.

You live (or store your vehicle) in an area that…

Is surrounded by trees

Is out in the open

Susceptible to theft

Regularly sees catastrophic weather conditions

You aren’t comfortable paying out of pocket for damage

If you have specific questions on coverage, you can reach out to our team at support@tint.ai or can speak with a licensed insurance expert at (909) 505-2338.

Disclaimer: Insurance is offered through Tint Embedded Insurance Services, LLC, a licensed surplus lines insurance broker, and underwritten by a non-admitted insurance carrier. In case of the insurance carrier’s insolvency, payment of claims may not be guaranteed. The information provided herein is for general informational purposes only and not intended as a solicitation of insurance. Such information does not in any way alter or amend the terms, conditions, or exclusions of any insurance policy. Insurance coverage may not be available in all jurisdictions or to all customers.